What is ESG? Environmental, Social, and Governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. Investors are increasingly applying these non-financial factors as part of their analysis process to identify material risks and growth opportunities.

|

|

What is the main purpose of ESG?

The promotion of ESG provides a more transparent platform for investors and major stakeholders of enterprises to have a further assessment of the investment direction, set up a better response for the investment system. There are three main purposes for investors and responsible investment:

● Provide the information to investors based on ESG information provided by the organisation, help investors to make better decisions;

● Increasing the return on the investment portfolio;

● Strengthen the social value and improve the supply chain;

● Provide basic information for responsible investment;

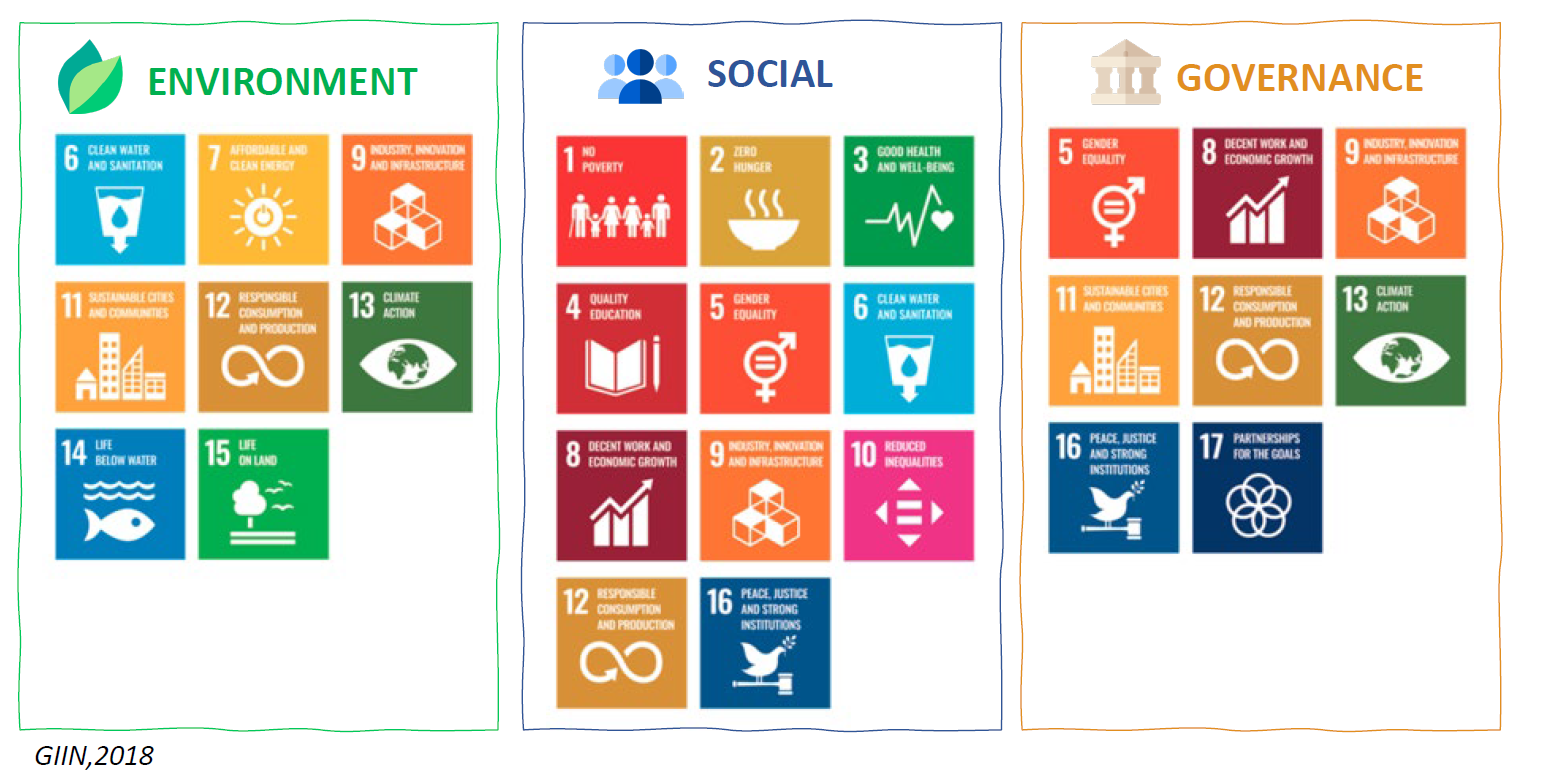

What is the relationship between ESG and SDGs?

The Sustainable Development Goals (SDGs), also known as the Global Goals, were adopted by all United Nations Member States in 2015 as a universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity by 2030.

The 17 SDGs are integrated—that is, they recognize that action in one area will affect outcomes in others and that development must balance social, economic and environmental sustainability.

Private Sectors is playing an important role in achieving global goals. More and more MNCs and listed companies started to map out the ESG topics with SDGs to express organisations’ desire and efforts in achieving sustainable development.

The relationship between ESG and Net-Zero Carbon Emission

ESG is an important part of promoting net-zero carbon emission. Because E in ESG involves climate change, natural resources, pollution and consumption, environment and governance, green development and other aspects. The current promotion of net-zero carbon emission and sustainable development strategies are closely linked.

What are the relevant ESG Disclosure regulations?

Singapore

Sustainability reporting complements the financial reporting of listed issuers. Statements of financial position and comprehensive income provide a snapshot of the present and an account of the past year, while sustainability reports of environmental, social and governance (“ESG”) factors show the risks and opportunities within sight, managed for future returns. Taken together, the combined financial and sustainability reports enable a better assessment of the issuer’s financial prospects and quality of management.

Effective 1 Jan 2022, SGX mandates climate and board diversity disclosures, which new requirements including:

● issuers to subject sustainability reporting processes to internal review;

● all directors to undergo a one-time training on sustainability;

● sustainability reports to be issued together with annual reports unless issuers have conducted external assurance; and

● issuers to set a board diversity policy that addresses gender, skill and experience, and other relevant aspects of diversity. Issuers must also describe the board diversity policy and details such as diversity targets, plans, timelines and progress in their annual reports.

Hong Kong

On December 2019, The Stock Exchange of Hong Kong Limited published the conclusions to its consultation on the ‘Review of the Environmental, Social and Governance (ESG) Reporting Guide and Related Listing Rules’ making revisions on the content of existing ‘Listing Rules’ and the ‘ESG Guide’. The amendments will apply to issuers’ ESG reports for financial years commencing on or after 1 July 2020.

China

In June 2021, the Ministry of Ecology and Environment of China released the Reform Plan for the Legal Disclosure of Environmental Information System, which set the basic formation of a mandatory environmental information disclosure system by 2025 as the main work goal, requiring the CSRC to further clarify the format of documents related to information disclosure by listed companies. Amendments shall be made to incorporate mandatory requirements for environmental declaration into the reporting rules for listed companies, and implement them in filing documents such as prospectuses.

Australia

In 2015, the Australian Council of Superannuation Investors (ACSI) and Financial Services Council (FSC) published an Environmental, Social, and Governance (ESG) Reporting Guide, which aims to assist companies in disclosing their ESG risks in a consistent and comparable manner that is useful for investors.

The 2015 Guide addresses institutional investors' expectations regarding the disclosure of material company-specific ESG risks and opportunities, to a level sufficient for investors to fully understand, price and manage those risks and opportunities. The recommended ESG disclosures are voluntary and address the environment, climate change, and human capital management as well as the broader community and other stakeholders.

In addition to investor-oriented disclosures, the Australian Corporations Act 2001 requires all companies to report on compliance with environmental regulations to which they are subject and on performance on relevant metrics.

If you want to know more about our ESG services, please feel free to contact us at contact@esg-biz.com